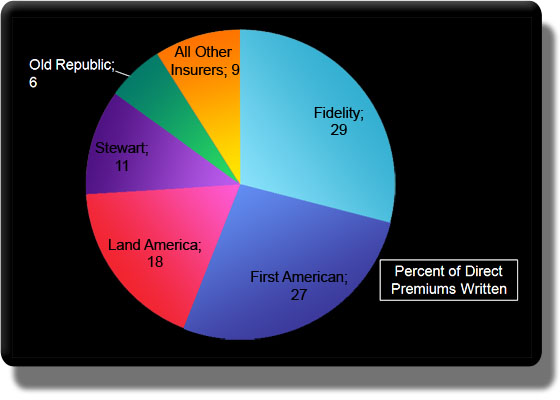

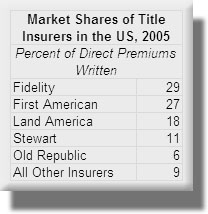

Market Shares of Title Insurers in the US, 2005

Just four firms dominate the $17 billion a year title insurance business in the US. Title insurance provides buyers of property with some assurance of clear ownership and an absence of competing claims over it. It is generally required in real estate transactions. It has come under scrutiny however, due to the subprime mortgage debacle. Much of the cost of title insurance is thought to stem from referral and other fees, which regulators believe are hidden from consumers. Title insurers pay brokers, lawyers and others who assist property buyers for referrals, since consumers generally do not shop around for title insurance. Although individual states specifically bar referral fees, some title insurance agents are believed to work with brokers to enable compensation that sidestep such legal boundaries. With evidence of a lack of competition in most states, the current credit crisis in the mortgage sector will likely give rise to changes in how title insurance is sold and what kinds of information must be disclosed to the end buyer.

Source: Government Accountability Office and Nechtain