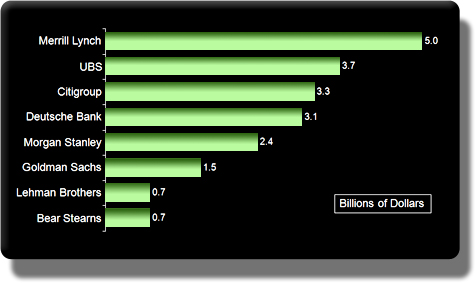

Fixed Income Asset Writedowns by Major Institutions, Q3 2007

For many years, the largest banks have been busy acting like investment banks: arranging loans and quickly readying them for re-sale to investors. As liquidity has dried up, they have begun to rediscover their roots as lenders who held loans on their own balance sheets. The credit market turmoil of 2007 began in the US with rising defaults on subprime mortgages, but quickly spread overseas because banks had repackaged those loans with more reliable ones and sold them to a wide range of investors, including several European banks. Credit dried up in early August, upsetting financial markets, as banks became wary of exposure to the risky loans. Since then, banks have begun to look for ways to clear some of the $300bn worth of leveraged loan commitments they made but are struggling to sell on following the credit turmoil.

Source: The Companies and Nechtain