Late Bloomers May Provide the Most Colourful Display

Spring always comes a little later to the Central and Eastern European economies and something similar may be true for the emerging payments sector in that region. As the former Eastern Bloc nations continue their transition to market-based economies, their respective payments sectors generally lag behind those of the more advanced economies, in terms of infrastructure and sophistication. As discussed below, there are grounds to believe this will change in the period ahead, especially for the “transition economies” that comprise eight of the ten Acceding Countries.

Current Status and Challenges Ahead

Relative to GDP, banking assets among the transition economies in the Acceding Countries are about one-third the level of banking assets in the euro countries. Domestic credit – which includes credit card borrowings – is also about one-third euro area levels. There must therefore be a question over the ability of the banking sector to bring to bear the resources that will be needed to support a modernizing payments sector.

Offsetting this is the fact that the banking sectors in Central and Eastern Europe have undergone a decade or so of restructuring and privatisation. As a result, among the Acceding Countries as a whole, foreign investors own more than two-thirds of banking industry assets, compared to around 20 per cent among the group of euro countries. With foreign ownership can come the necessary expertise and resources to modernize. Entry to the EU will likely hasten the desire among banking institutions to do so.

Even in the absence of a strong banking sector, over the past decade, much has begun to change in how payments occur in Eastern and Central Europe. Although cash remains a key means of payment in the region, measures of cash in circulation suggest its decline.

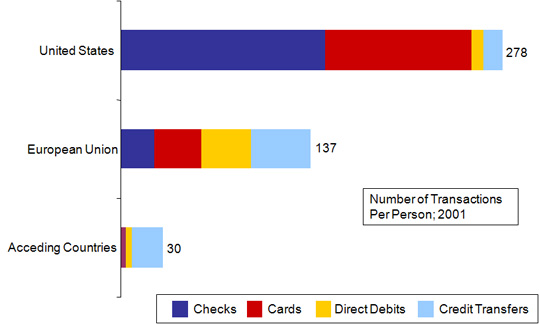

There is still quite a “gap” with more developed regions, however. During 2001, consumers in the Acceding Countries averaged 30 payments that did not involve cash. That pales in comparison to the 137 cashless payments made by the EU’s citizens or the 278 non-cash payments made by Americans, on average, in the same year (see Chart 1). Although some of the difference may be attributed to lower spending power relative to consumers in the US or the current EU, the predominance of cash in the Acceding Countries is also a significant factor.

Helping to close the gap is the trend for increasing numbers of employers to pay their staff by direct deposit, using credit transfers. The significance of this is hard to overstate. In many of the Acceding Countries, a considerable segment of the population is “unbanked” and effectively excluded from non-cash payment options. With direct deposit, this is changing. Workers are opening bank accounts to receive their wages, and banks are taking the opportunity to bundle their account offerings to include debit cards and access to other services, such as ATM machines.

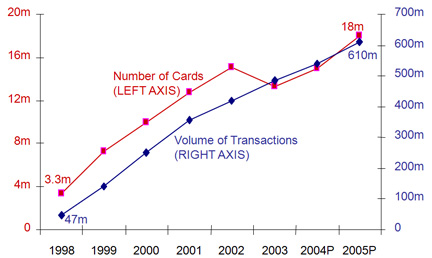

As a result, there has been an explosion in the number of debit cards in circulation, as workers access their wages with debit cards that double as cash cards, at ATM machines. In Poland, by far the most populous of the Acceding Countries with 38m citizens, debit card penetration and usage have grown in tandem (see Chart 2). A similar picture has emerged throughout the region.

If recent trends continue, debit card adoption and usage in many of the Acceding Countries’ economies will begin to resemble that of much of the European Union, within the next few years.

Other payment alternatives to cash are also finding their way to the Acceding Countries. In parts of the region, such as Poland, direct debits were only recently introduced and have begun to take root. In other economies, such as the Czech Republic, Estonia, and Slovenia, direct debits have been around longer but are just now becoming major payment instruments. Despite being relatively new to the payments environment, consumers in the Acceding Countries now make more payments by direct debit than they do using cards (combined, debit or credit).

Additionally, by both value and volume, credit transfers are, by far, the most important payment instrument in the region as a whole.

What we are witnessing is the emergence of a modern, electronic payments system which is, to a large degree, by-passing outmoded paper-based instruments still in use in western economies.

Cheques are almost non-existent in the Acceding Countries and will remain so.

Overall, transfers and debit cards are the dominant payment instruments replacing cash in the settlement of debts in the Acceding Countries. The changes already underway will likely accelerate post-EU membership, with greater movement of people into and out of the region and a potential for enhanced competition in financial services.

Chart 1

Number of Payments per Person Not Involving Cash, 2001

Note: Data for the United States are for 2002

Source: European Central Bank, Bank for International Settlements and Nechtain

Chart 2

Debit Card Payments in Poland, 1998-2005P

P: Nechtain Projection

Source: National Bank of Poland and Nechtain

There are challenges ahead, however.

Credit Infrastructure. A lack of supporting “infrastructure” means that credit cards are a niche product throughout much of the region. Widespread availability and use of quality credit bureau data is some way off, and even the largest banks in the region do not deploy the kinds of advanced statistical modelling to assess customer risk that are typical of major card issuers in western markets. In this area too, the presence of western-owned banks and the prospect for increased competition in financial services following EU entry may encourage efforts to modernise.

Technology. Greater technology investments by banks and other financial institutions are needed to support broader access to the payments system. Delivery channels (including branch, web-based and ATMs) are improving but remain under-developed relative to much of the EU and the US.

Merchant Acquisition. For cards, merchant acceptance remains a problem. Among the transition economies entering the EU this month, only Slovenia has an installed base of POS terminals on par with EU and US levels. The challenge going forward will be to convince a wider base of retailers of the need to accept POS terminals, particularly given that cash has always been the preferred means of payment.

Impact on Existing EU Members and Payments Sectors

The impact of the Acceding Countries on the EU payments sector will be felt in a number of ways.

In the payments sector, banks and others seeking scale advantages may decide to concentrate back-office and call center activities in lower cost centers operating within the Acceding Countries.

Western businesses may also benefit from upgrades to payment systems in the Acceding Countries. Software and hardware firms, along with consultants, marketing firms, among others, will stand to benefit from accelerated efforts to modernize payments systems in the transition economies.

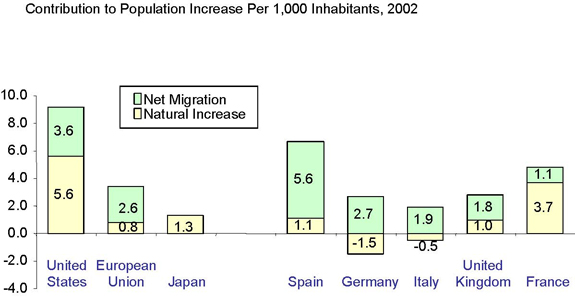

Longer term, the anticipated movement of people from the Acceding Countries to parts of the current EU will have an impact on payments. Their combined population of 74m citizens represents an increase of about 20% to the current EU population. This is non-trivial, given the fact that migration has become so critical to the EU’s well being. In 2002, net migration of almost 1m people accounted for more than 75% of the EU population increase (see Chart 3).

Over time, migrants – including those from the Acceding Countries - will increasingly be represented among the younger demographic groups in the existing EU countries. Migration gives rise to an increased need for remittance services, as they will likely be sending funds to their relatives in their home country. This can be significant business for banks: Latin Americans working abroad last year sent back home an estimated $38 billion. Migrants will also likely be more receptive to offers of credit and, more generally, be a new source of business to financial institutions, as they establish themselves in their new homes. Recent migration levels to the EU have been around 1m people, net, annually – and this will likely increase (relative to the current EU members) as the Acceding Countries gain entry to the current fifteen EU members’ labor markets.

As we look to the future, is clear that the Acceding Countries and its peoples will have some impact in shaping the payments sector(s) in the current EU. It is equally clear that payments in the Acceding Countries are starting to resemble those of advanced economies elsewhere. Entry to the European Union will likely expedite modernisation that has been underway since the late 1990s. Spring may always come late to the countries of Central and Eastern Europe, but soon enough their payments systems will not be so far behind the rest of Europe.

Chart 3

Importance of Migration to Population Growth in the EU, Japan and the US

Source: Eurostat, Council of Europe, US Bureau of the Census and Nechtain

Michael J. McEvoy is a co-founder of Nechtain LLC

www.nechtain.com