Banks May Be Retrenching, But Not in Their Tech Budgets

Strong Impetus for IT Investments

While few would argue that banks have been slow innovators, our research at TowerGroup provides a constant reminder of the massive resources being spent by banks on technology. The big question is whether or not the current economic downturn means disinvestment in technology investment and an end to the double-digit IT budget increases we’ve seen in recent years.

Overall, TowerGroup projects IT spending of US $31.4 billion by US banking institutions on information technology during 2001, corresponding to almost $17,000 per employee. Our IT spending estimates are based on a broad definition of IT spending that includes both internal and external spending across hardware, software and services. “Internal” spending includes fully-loaded employment costs of IT staff and their managers, including associated facilities costs.

The reality is that investment in technology has become a great necessity on two major fronts. Firstly, one of the great impacts of technology on financial services is to make the traditional demarcations increasingly obsolete, as IT makes it easier for institutions to quickly move into each others' “space”. Secondly, financial institutions view technology as a necessity to enable them respond to elevated consumer and business expectations. Retail customers want products and services that match their increased prosperity and changing lifestyles, while businesses want quick, reliable and global access to information and finance.

Chart 1 illustrates TowerGroup’s view of the relationship between IT spending and institutional revenue and non-interest expense for different sizes of institution. As we move up the size categories, IT spending grows as a proportion of both revenue and non-interest expense. Over time, industry IT spending is becoming a larger share of bank operating expense, partly in response to the emergence of new technologies, such as the Internet.

Although the number of banks in the US continues to decline, industry spending on information technology continues to grow. In fact, continuing industry consolidation supports outlays on IT, since larger institutions spend disproportionately more on IT. Just three institutions, Citicorp, Bank of America and Chase Manhattan between them are expected to spend $11.8 billion on information technology during 2001 – equivalent to 40% of the industry total.

Chart 1

IT Spending in Relation to US Bank Revenue and Non-Interest Expense

|

Institution Type |

Estimated IT Spending as Proportion of Institution Revenue |

Estimated IT Spending as Proportion of Non-Interest Expense |

Comments |

|

Largest banks (holding company assets above $50 billion—17 institutions) |

3.5-8% |

16-22% |

More complex business lines; all delivery channels utilized Higher volumes: greater business justification for automation through IT High expectation among customer base to be “leading edge”, provide service through all possible delivery channels |

|

Other large banks (assets of $5 billion to $50 billion—144 institutions) |

1-4% |

9-18% |

Less cross-border business Greater emphasis on (less complicated) retail businesses Minimizing IT outlays through outsourcing (i.e. ASP) arrangements is more of an option than with the largest institutions |

|

Community banks and small institutions (assets below $2 billion) |

0.5–2% |

4-10% |

Fewer reasons to automate: lower volumes, less complexity in products offered Fewer lines of business Less pressure from customer base to be “cutting edge” |

Source: TowerGroup

Longer-term, consolidation will help ensure healthy annual increases in IT investments. Despite the perception that financial services are already highly concentrated, a comparison with some other industries suggests that there is a long way to go: Citicorp, the largest and most “global” banking institution has just a 3 or 4% market share, compared with General Motors’ 30% and Wal-Mart’s 40% share, respectively. Wal-Mart, a US discount retail chain, is so large that it has more people working for it than are believed to be employed by dot.com companies in the US (an estimated 900,000).

Short-term Hiccups

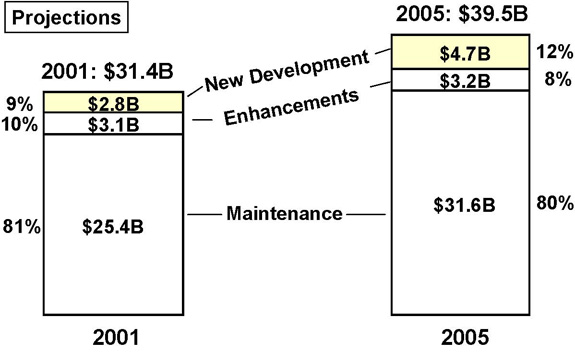

Many have pointed out that, over the near-term, a slowing US economy and falling profits for banks, combined with an end to a period of large-scale projects to confront challenges such as Y2K and the implementation of the euro, suggest slower growth in IT spending for 2001. Critically, what many overlook is that a strong proportion of overall IT spending is maintenance related (see Chart 2), with the result that much of IT spending is relatively insulated, at least in the short-term, from cutbacks that may impact the business generally. This is more true in banking than the securities industry, where spending has grown at a rapid pace in recent years as firms invested heavily in new development in areas like on-line trading. Proportionately, there is far less “discretionary spending” going on in banking, and consequently less room for cutbacks.

Chart 2

Maintenance vs. Development Split of IT Spending by US Banks

Source: TowerGroup

If a prolonged downturn were to occur, institutions may choose to outsource more as a means of internal cost-cutting. Traditionally a back-office endeavor concerned with extracting scale economies from high volume processing (such as check processing), outsourcing has evolved to become more acceptable to financial institutions for other parts of their businesses. In the past, for instance, institutions were reluctant to allow third-parties (outsourcers) to interact directly with their customers, but that has changed. Front-end customer acquisition for consumer credit, for example, is a thriving business among specialist outsourcers catering to large community banks and, in a few cases, large money-center institutions. Over a longer period, banks could, of course, choose to accelerate their decisions to outsource, or find other ways to cut IT spending (through mergers, moving to third-party solutions, etc.).

The End is Not Nigh

To answer the question posed at the start of this article, banks will continue spending a bundle on IT – not because they necessarily want to, but because they have to. While an economic slowdown has begun, most IT spending is relatively insulated from short-term cutbacks by banks. Over the long-term, however, changes are occurring – such as a switch to outsourcers and third-party solutions – and these shifts will likely accelerate if a decline in bank profitability starts squeezing IT budgets in the period ahead.

Meanwhile, IT spending accounts for a large and growing portion of US bank operating expense – and this will continue with or without a recession in the general economy.

Michael J. McEvoy is a co-founder of Nechtain LLC

www.nechtain.com